Up to $26,000 per Employee Still Available!

- Get your Tax Refund Checks from the IRS for ERC

- Zero money upfront and Free Analysis

- Qualify for all 6 quarters in just minutes

- You don’t have to pay this back. It’s not a loan

Your ERC is Insured by Audit Protection

Professional Liability Errors & Omissions Insurance

![]()

Get Qualified Today!

100% Risk Free

Beware of who you trust to get your ERC refund.

Checkout the IRS’s News Release with guidelines on who to trust.

We Make This Easy!

Our Simple 4-Step Process

WE QUALIFY YOU

Apply Now

WE FILE YOUR ERC

Submit your documents

RECEIVE YOUR ERC CHECKS IN THE MAIL

From the US Treasury

YOU PAY US

Only after your ERC check has cleared

Our 3-Tier QA Process

Accuracy

Maximized ERC Amount

Successfully Approved

Find Out Why Professional Liability & E&O Insurance is Important

Professional Liability Errors & Omissions Insurance

![]()

What is your fee and when do I pay it?

Our fee includes preparation of your claims by professionals who are experienced in qualifying, calculating, and filing your ERC claim. (We have Berkshire Hathaway’s Professional Liability and Errors & Omissions Insurance: We Stand by Our Work).

How do you make it risk free?

We Stand By Our Work.

100% Guaranteed and Our Work is backed by Berkshire Hathaway Insurance Professional Liability Errors & Omissions Insurance.

150 Page report of your Qualifications, Calculations, Application, & Major Government Orders

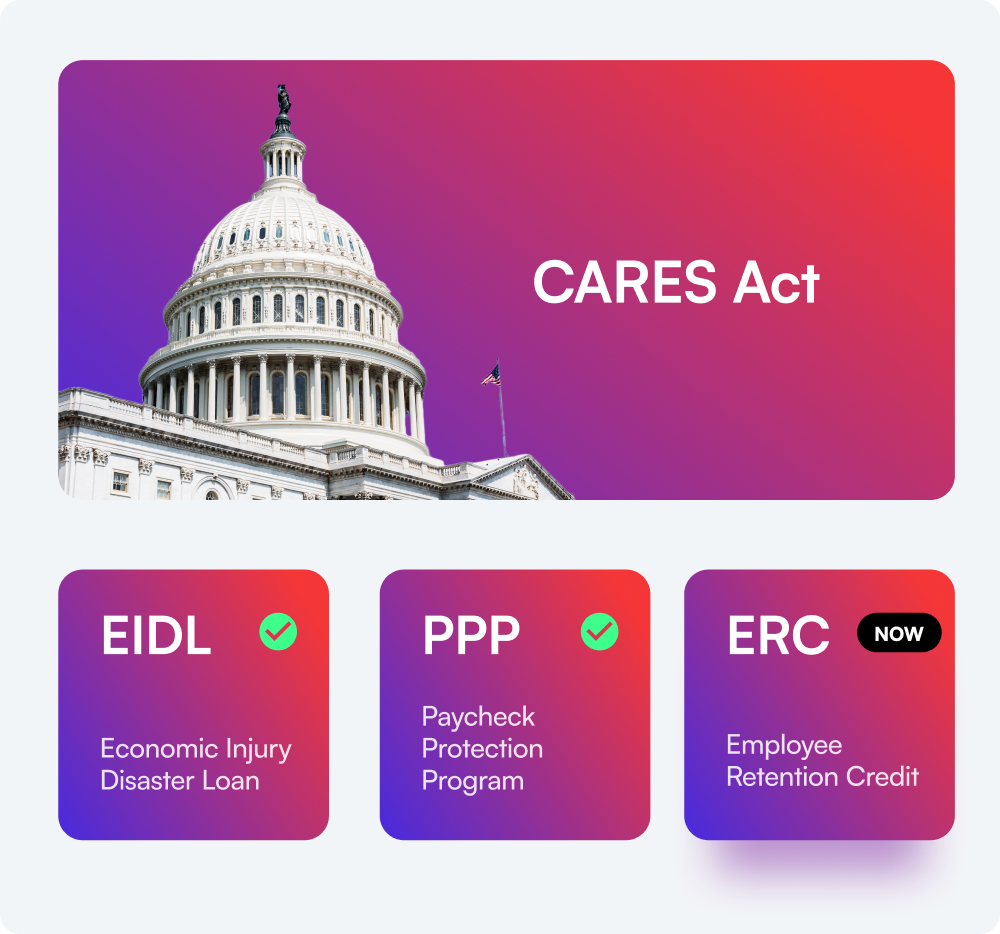

We Ensure you remain compliant with IRS Circular 230 and in your calculations by preventing double-dipping with other CARES ACT programs.

What if I didn't have any Revenue Loss - Do I still qualify?

Can I get ERC money if I received PPP?

ERC is a better incentive than PPP. Typically, 2-5x More Money.

Your business can now have PPP1 & PPP2 and ERC, however, special calculations are required as you cannot double-dip into the same payroll calculations. We know how to optimize your ERC amount and are known for getting clients 20-40% more ERC.

Can't I just have my CPA or Payroll company file it? Why should I use ERC Guaranteed?

- Most payroll companies and CPA’s do not take responsibility for their miscalculations or omissions. The liability is on the Business owner, or client (We have Professional liability insurance, which is documented in your agreement).

- No Insurance to protect you from their mistakesNo Qualification processes

- The Employee Retention Credit is a Government Incentive. Payroll companies and CPA’s do not specialize in government incentives or ERC Tax Codes. For this reason, some of our clients were told they were not eligible for ERC by their CPA or Payroll companies.

- No Access to government orders

- Wrong Calculations which then translates to a lower ERC refund for companies.

Why do I need an ERC Firm?

There are over 75,000 pages of U.S. tax code including federal tax regulations and official tax guidance. ERC and a few other Tax Credits is all we do. It’s analogous to a specialized physician versus a general family practitioner. We specialize in the ERC Tax Code.

We take pride in knowing how to validate your eligibility and accurately calculate your ERC.

It’s as important to us as it is to you to remain compliant.

We get you the money properly so you can keep it too.

How do I know if my business qualifies?

But I've been told already that my business does not qualify.

Do I have to repay ERC money and is this taxable?

You do not have to repay the Employee Retention Tax Credit. This is not a loan. ERC is a reward to business owners for retaining their employees during their qualifying periods.

The ERC credit is not considered income for federal income tax purposes, but a reduction of payroll, so you must reduce any deductible wage expenses by the amount of the credit.

After receiving your ERC checks, does the IRS then only require businesses to amend their business tax returns for those respective years (2020 & 2021). The ERC credit is not considered income for federal income tax purposes, but a reduction of payroll, so you must reduce any deductible wage expenses by the amount of the credit. We provide our clients these details after filing if they choose to do it themselves, their CPA or they can choose to have us do it for them.

How long do we have to file ERC?

How long will it take to get my ERC check?

The IRS is taking 3 to 4 months to process ERC files. They directly mail you the approval letter and the checks.

As an owner do my wages, or the wages of any family member I employ qualify?

Can I qualify for the ERC if I'm self-employed or have 1099 employees?

What is Employee Retention Credit?

Created by the CARES Act, the Employee Retention Credit (ERC) is an economic stimulus program that rewards eligible employers for retaining employees on their payroll W2s. If your business implemented safety measures, or experienced COVID-related disruptions, or government-imposed restrictions throughout the pandemic in 2020 and 2021, you are eligible for this program.

Retention Program Amendments

It was amended various times to ensure that big and small businesses get the compensation they deserve. Here are the amendments that took place:

The Taxpayer Certainty along with the disaster Tax Relief Act of 2020

(Relief Act) revised and extended this economic stimulus for the first and second calendar quarters of 2021.

The American Rescue Plan Act of 2021

(ARP Act) altered and extended this tax retention credit for the third and fourth quarters of 2021.

The Infrastructure Investment and Jobs Act

(Infrastructure Act), terminated ERTC for wages received in the fourth quarter of 2021 for employers that are not recovery startup businesses.

See the IRS Tax Code Now

We know how you qualify. We guarantee it!

Under the consolidated appropriations act, ERTC was amended in 2021 to provide up to $5,000 per employee for 2020, and up to $7,000 per employee for each of the first three quarters of 2021.

A large or small Business can receive up to $26,000 per employee.

This incentive pays a greater incentive for eligible employers than Pay Check Protection Program because you are not required to use it for business expenses. It is not a loan, it is yours to keep.

It’s Your Capital, Waiting for You

There’s currently $400 billion approved for ERC. How much ERC money is ready to be given to your business?

What Makes Us Uniquely Better

-

We Protect You

Our work is insured by Berkshire Hathaway

-

Get More ERC Money

We know how you qualify for all 6 quarters

-

Get Your Full Documents

We give you a full 150+ page detailed report of all your government orders & calculations

-

2,000+ 5-Star Google Reviews With Our Fulfillment Partners

Others have very little to no reviews

Talk to a Specialist Now

How much is waiting for your business? Get qualified in minutes NOW.

Confirm Your Qualification in 4 Minutes

Start Your Process – Speak to a Specialist

File with Assurance

Our tax and government order specialists ensure the accuracy of your ERC

- No upfront fees

- We stand by our work & help in case of audit

- ERC work is backed by insurance – Audit Protection

- 256-bit encryption to secure your information

- Successfully Approved

Live Support You Can Trust

Our clients have real people responding to them when needed. We are fast, efficient, and highly responsive.

The ERC Specialist assigned to you ensures accurtate qualification. caluclations, and quick filing.

Up to $26,000 per Employee Still Available!

- Get your Tax Refund Checks from the IRS for ERC

- Zero money upfront and Free Analysis

- Qualify for all 6 quarters in just minutes

- You don’t have to pay this back. It’s not a loan

Your ERC is Insured by Audit Protection

Professional Liability Errors & Omissions Insurance

![]()

Get Qualified Today!

100% Risk Free